PESTEL分析:mant251管理和組織

03-16, 2016

Strategic Management The industry analysis

戰(zhàn)略管理的行業(yè)分析

行業(yè)分析的目的

了解產(chǎn)業(yè)結(jié)構(gòu)帶動(dòng)競(jìng)爭(zhēng),這決定了行業(yè)盈利水平

評(píng)估行業(yè)吸引力

利用對(duì)產(chǎn)業(yè)結(jié)構(gòu)變化的證據(jù)來預(yù)測(cè)未來的盈利能力

制定策略以改變產(chǎn)業(yè)結(jié)構(gòu)來提高行業(yè)的盈利能力

識(shí)別關(guān)鍵成功因素

行業(yè)盈利能力的關(guān)鍵因素

三個(gè)關(guān)鍵因素:

1產(chǎn)品的價(jià)值給客戶

2競(jìng)爭(zhēng)強(qiáng)度

3相對(duì)議價(jià)能力在價(jià)值鏈的不同階段

The Objectives of Industry Analysis

To understand how industry structure drives competition, which determines the level of industry profitability

To assess industry attractiveness

To use evidence on changes in industry structure to forecast future profitability

To formulate strategies to change industry structure to improve industry profitability

To identify Key Success Factors

Key determinants of industry profitability

Three key influences:

1 The value of the product to customers

2 The intensity of competition

3 Relative bargaining power at different stages of the value chain

Pestel framework continued…PESTEL框架繼續(xù)…

政治因素,如政府政策、稅收的變化,在國(guó)外市場(chǎng)的政治風(fēng)險(xiǎn),政府補(bǔ)助/補(bǔ)貼。

經(jīng)濟(jì)因素,如個(gè)人可支配收入、匯率、失業(yè)率、通貨膨脹率、國(guó)民經(jīng)濟(jì)增長(zhǎng)率。

社會(huì)文化因素如人口變化、生活方式的改變,文化和時(shí)尚,改變移民的國(guó)際學(xué)生。

技術(shù)因素:技術(shù)的發(fā)展,ICT創(chuàng)新,增加研發(fā)支出。

環(huán)保(綠色的)因素,如碳排放(汽車)、能源(水)、廢物處理和回收。

法律因素如競(jìng)爭(zhēng)法(兼并)、健康與安全法,勞動(dòng)法,機(jī)場(chǎng)的權(quán)利,禁煙令。

Political Factors e.g. government policies, taxation changes, political risk in foreign markets, government grants/subsidies.

Economic Factors e.g. personal disposable income, exchange rates, unemployment rates, inflation, national growth rates.

Socio-cultural Factors e.g. population changes, lifestyle changes, changes in culture and fashion, emigration, international students.

Technological Factors e.g. Technology developments, ICT innovations, increased spending on R&D.#p#分頁(yè)標(biāo)題#e#

Environmental (‘Green’) Factors e.g. carbon emissions (cars), energy consumption (water), waste disposal and re-cycling.

Legal Factors e.g. competition laws (mergers), health and safety laws, employment laws, airport rights, smoking ban.

Pestel continued….

PESTEL forces can be complex and intertwined. It can be better to focus on the key drivers for change – the environmental factors most likely to have a high impact on the success or failure of a strategy, i.e. high priority.

In complex or uncertain environments it is difficult to develop definitive views on the influences on strategy. Scenarios are plausible views of how the environment of an organisation might develop in the future based on key drivers of change about which there is a high level of uncertainty.

Porter’s Five Forces Competition Framework

Porter’s five forces framework helps identify the attractiveness of an industry in terms of five competitive force - the more immediate environment and the competitive forces at play.

Industry analysis: Five forces model

1. The Threat of Entry and Barriers to Entry

Barriers to entry are the factors that need to be overcome by new entrants to enter the market and to compete.

The easier it is the worse it is for incumbents – i.e. greater competition.

Examples - economies of scale; know-how; investment; legislation; retaliation; access to supply chains; product differentiation

2. Threat of Substitutes

Products or services that offer a similar benefit to an industry’s products or services.but by a different process.

Puts a cap on prices that can be charged in an industry.

Encourages managers to look outside their own industry, and to consider more distant threats and constraints.

Price/performance ratio is crucial as is the buyers propensity to avail of substitutes

3. Power of Buyers

The immediate customers – the more powerful they are the more they can ask for Key issues - concentration; switching costs; backward integration; buyer’s information; price sensitivity – % of total cost; is it a commodity or differentiated?

#p#分頁(yè)標(biāo)題#e#

#p#分頁(yè)標(biāo)題#e#

Five forces continued

4. Power of Suppliers

Suppliers are those who supply the organisation with what they need to produce the product or service - finance, raw material, fuel.

Key issues – concentration (iron ore); switching costs (Microsoft); forward integration; price sensitivity

5. Level of Competition Rivalry#p#分頁(yè)標(biāo)題#e#

Competitive rivals are organisations with similar products and services aimed at the same customer group and are direct competitors in the same industry/market (they are distinct from substitutes).

The more competitive it is, or where the forces are high, the worse for incumbents, i.e. the less attractive it is – too much pressure and competition..

Other forces worth noting include competitor balance/diversity; industry growth rate; high fixed costs; high exit barriers; cost conditions (e.g. ratio of fixed to

variable costs).

Once the degree of attractiveness has been understood, the five forces can help

set an agenda for action.

Five forces concluding points

Implications of five forces

Which industries should we enter or leave – industry attractiveness.

If we can forecast changes in industry structure we can predict the likely impact on competition and profitability. Helps with planning and positioning.

What influence can we exert? – use deliberate management strategies to influence structural variables that are depressing profitability.

The size of the company is a factor.

You must analyse at the right industry level

Crucial to consider timing issues and lifecycle issues in your analysis.

Is the five forces model out-dated?

Convergence of industries – particularly in the high tech sectors (e.g. digital industries - mobile phones/cameras/mp3 players).

Complementary products and services. An organisation is your complimentor if 1) customers value your product more when they have the other organisation’s product than when they have product alone 2) if it is more attractive for suppliers to provide resources to you when they are also supplying the other organisation than when they are supplying you alone.

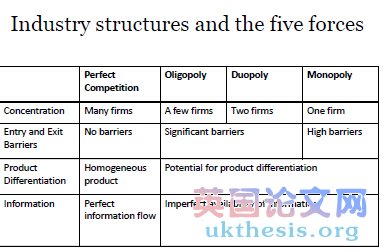

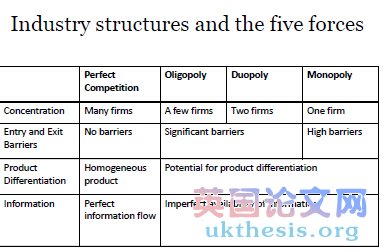

Types of industries

Monopolistic industries - an industry with one firm and therefore no competitive rivalry.

A firm has ‘monopoly power’ if it has a dominant position in the market. For example,

BT in the UK fixed line telephone market.

Oligopolistic industries (or duopoly) - an industry dominated by a few firms with limited rivalry and in which firms have power over buyers and suppliers.

Perfectly competitive industries - where barriers to entry are low, there are many equal rivals each with very similar products, and information about competitors is freely available. Few (if any) markets are ‘perfect’ but may have features of highly competitive markets. Difficult to ear much profit and competition is primarily based on price.

#p#分頁(yè)標(biāo)題#e#

#p#分頁(yè)標(biāo)題#e#