英國布拉德福德大學:ID-4246M講座第9周匯率套匯和一價定律

Week 9: Exchange Rates

第9周:匯率

ID-4246M

Dr V G Fitzsimons

University of Bradford

ID-4246M

V G菲茨西蒙斯博士

布拉德福德大學

Foreign Exchange Markets

外匯市場

• In this lecture

在這個演講中

• Review of Exchange Rates

匯率回顧

• Arbitrage

套匯

• Law of One Price (LOOP)

一價定律(LOOP)

• Purchasing Power Parity (PPP)

購買力平價(PPP)

• Interest Rate Parity (IRP)

利率平價(IRP)

• Uncovered interest parity (UIP)

無拋補利率平價(UIP)

• Covered interest parity (CIP)

補利率平價(CIP)

• Exceptions to the rule – does PPP (and IRP) hold?

該規則的例外 – 是否持有PPP(IRP)?

• Non-tradeable goods

非流通貨物

• Long-run conditions

長期運行條件

• Inflation in international transactions

在國際交易中的通貨膨脹

• Relative Purchasing Power Parity

相對購買力平價

• The Fisher effect

費雪效應

http://ukthesis.org/gjswglzy

Reminder – exchange rates

提醒 - 匯率

• The exchange rate is the price of our currency if bought in foreign currency

外幣匯率是如果我們用外幣流通的價格

– e.g. £1 might cost $1.50 in the foreign exchange ‘spot’ markets (on average)

• This would be written

這將被寫入

E$/£ = 1.50

• Of course, it can also be quoted the other way, £s needed to buy ‘forex’

當然,它也可以被引用的其他方式,英鎊需要購買'外匯

E£/$ = 0.66

= the inverse of the $/£ exchange rate, i.e. 1/1.50 or 2/3

• Be careful to check which the book is using!

爭取仔細檢查哪本書是使用的!

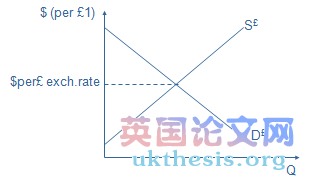

• The price of the currency is determined by the demand for it and supply of it:

貨幣價格是由它的需求和供應:

D£= f(the country’s exports, financial inflows to it for investment, e.g. due to high interest rates)

S£= f(the country’s imports, financial outflows to invest elsewhere)

Basic principles: Arbitrage

基本原則:套利

• Arbitrage:

套利

• ‘Arbitrage involves the simultaneous purchase and sale of an asset, such as currency, at different prices. It produces a risk-free, instantaneous profit’#p#分頁標題#e#

Eaker, Fabozzi & Grant, 1996, p.563

套利涉及同時購買和出售資產,如貨幣,以不同的價格。它產生無風險的利潤,瞬時“伊克,法博齊 - 格蘭特,1996,P.563

Arbitrage

套利

• If markets work efficiently, no arbitrage opportunities should exist..

如果市場高效地工作時,沒有套戥的機會的應該存在的

– ‘Arbitrageurs’ will repeatedly purchase the item in the relatively cheap market, driving up (demand and therefore) prices;

“套利”會反復購買該項目在價格相對便宜的市場,哄抬價格(需求,因此)

– and they will repeatedly sell the item in the relatively expensive market, raising supply and driving down prices.

他們會反復出售該物品在相對昂貴的市場,提高供給和壓低價格。

LOOP – the ‘Law of one price’

LOOP - “一價定律”

• Arbitrage is the principal mechanism behind the ‘Law of One Price’ (LOOP) in international economics.

套利是背后的“一口價法則“(LOOP)在國際經濟學的主要機制

• ‘The law of one price states that identical goods must sell at identical effective prices’

Eaker, Fabozzi, & Grant, 1996, p.566

法律一價狀態,相同的貨,必須在相同的有效價格出售'伊克,法博齊 - 格蘭特,1996,p.566

• The ‘effective price’ would be the price in another country’s currency, ‘translated’ by the exchange rate into our currency

“有效價格”將在另一國貨幣的價格,“翻譯成”我們的貨幣匯率

The ‘LOOP’ exchange rate?

“LOOP”匯率?

$P = $/£ELOOP. £P

Which implies:

$/£ELOOP= $P / £P

E.g.

A loaf of bread costs £0.50 in the UK but costs $0.60 in the US – what would the LOOP exchange rate be?

一個面包成本£0.50在英國但成本0.60美元在美國,如果回路的匯率是?

ELOOP= $0.60 / £0.50

= (0.60/0.50) $/£

= 1.20

( which is the number of $/£)

2004 December Big Mac index – China cheapest, and Switzerland most expensive!

2004年12月巨無霸指數——中國最便宜的,和瑞士最貴的!

Question: Using prices to work out exchange rates

提問:使用價格匯率

• Using the Big Mac data, work out the ‘law of one price’ exchange rate for the following:#p#分頁標題#e#

使用的巨無霸的數據,制定出“一口價”匯率法的以下內容

• The Chinese Yuan against the US dollar

中國人民幣兌美元

• The Chinese Yuan against the Swiss Franc

中國的人民幣兌瑞士法郎